C P Krishnan

THE moratorium declared on Punjab and Maharashtra Co-operative(PMC) Bank in September 2019 had sent shock waves throughout the country. The depositors of this bank could not withdraw more than Rs 50,000. Deposits of about Rs 12,000 crore got stuck up and due to this abominable situation, nearly 10 depositors lost their precious lives. The PMC crisis brought the concern about limit of the DICGC (Deposit Insurance and Credit Guarantee Corporation-owned subsidiary of Reserve Bank of India) coverage of one lakh rupees to the public domain and that eventually made the government raise the limit to five lakh rupees. Even after six months of declaration of moratorium on PMC bank, no solution has been arrived at. Again in March 2020, the moratorium has been extended by another three months. While the rulers could resolve the financial crisis of Yes Bank within 15 days, they are not ready to resolve the financial crisis of PMC co-operative bank even after 6 months. This gives a clear message that while the rulers are keen to save the new generation private banks which by and large serve the elite class, they are not ready to rescue cooperative banks which serve common man.

CKP COOPERATIVE BANK

On May 2, 2020 the Reserve Bank of India (RBI) has cancelled the licence of Mumbai based CKP Cooperative Bank with effect from April 30, 2020. The reason cited was that the financial position of this bank was highly adverse and unsustainable. Further according to RBI, “if the bank was allowed to carry on its business any further, public interest would be adversely affected”. Consequent to the cancellation of the licence of this bank, it is prohibited from conducting the business of banking which includes acceptance and repayment of deposits as defined in the Banking Regulation Act 1949.

CENTURY OLD BANK

Founded in 1915, the CKP Co-operative Bank Limited is a century old bank with eight branches. As of November 2019 its deposit was Rs 485.56 crore, loan Rs 161.17 crore and share capital Rs 62.50 crore and its net worth was Rs(-)239.18 crores. Out of Rs 158 crore outstanding loan as on March 31, 2020, Rs 153 crore i.e., 97 per cent of the loans became non-performing assets. The majority of the loan of this bank was given to 10 real-estate firms. While RBI oversees the banking functions, administrative and auditing oversight remains with the state registrar of the cooperative societies.

BOARD SUPERSEDED

The Board of directors of this bank was superseded by RBI on May 8, 2012 about 8 years ago. The CKP bank was put under restrictions as per section 35 (A) read with section 56 of Banking Regulation Act 1949 by RBI on May 2, 2014 about 6 years ago, as the superseded board could not resolve the crisis for two years. Since then the depositors have not been allowed to withdraw their money. In 2019 May, the depositors submitted a memorandum to the prime minister to revive the bank in order to protect their interest.

DEPOSITORS LOSE 120 CRORES

According to the RBI spokesperson Yogesh Dayal, “out of 1,32,170 depositors, 99.2 per cent will get full payment of their deposits from DICGC as the maximum limit of insured deposit coverage has been increased from Rs 1 lakh to 5 lakh this year; the remaining 0.8 per cent of the depositors i.e., 1,130 depositors who have more than Rs 5 lakh in their accounts will together lose Rs 120 crore, which is about 25 per cent of the total deposit amount of the bank.”

The superseded board could not revive this bank for eight long years. The depositors were put to severe ordeal for six long years since 2014 as they were not allowed to withdraw their own money in the bank. The reason for the failure of many of the Co-operative banks, private banks or non-banking financial institutions is reported to be fraud at the top level which the concerned authorities have failed to detect and arrest in time; but they remain unaccountable. Only the poor depositors are made to suffer and ultimately some of them lose their hard-earned lifetime savings.

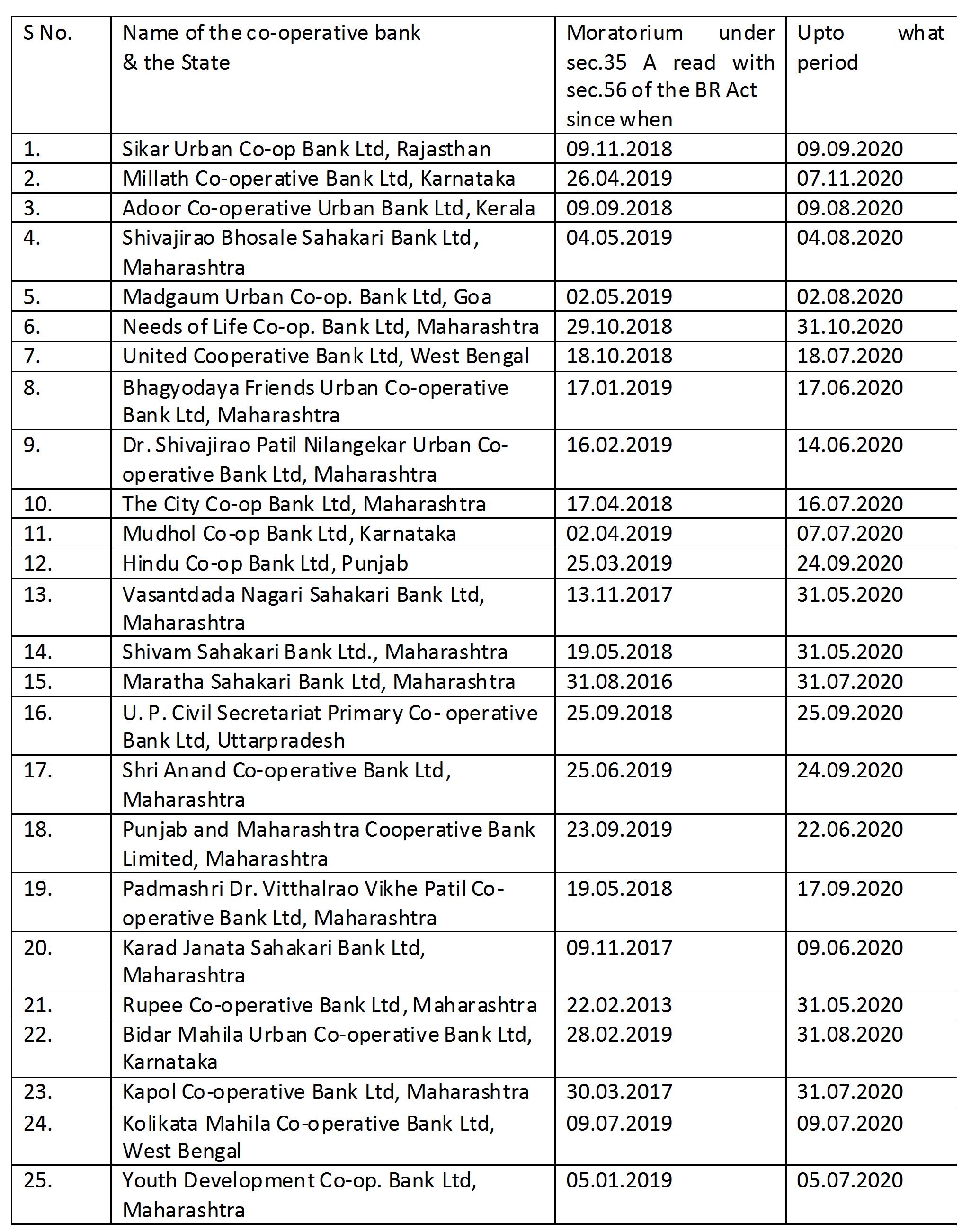

Here is a list of some of the cooperative banks which remain under moratorium as of today.

From this, it can be observed that some banks remain under moratorium for years together; for instance Rupee Co-operative Bank Limited from February 2013 and Maratha Sahakari Bank Limited form August 2016. Some other banks remain under restrictions imposed by RBI for more than one or two years.

The depositors of these banks cannot withdraw their own money from these banks from the date these banks are put under restrictions under section 35 A read with section 56 of BR Act 1949. One can imagine their plight and the traumatic situation they would have undergone, being unable to utilise their own savings even for their essential house hold needs.

As far as the CKP Cooperative Bank is concerned:

• RBI should reconsider its decision of cancellation of licence of CKP Cooperative Bank.

• Attempts should be made to revive the bank or amalgamate this bank with another viable co-operative bank in a time-bound manner.

As far as all the cooperative banks are concerned:

• Central and state governments have to infuse funds to safeguard CKP Cooperative Bank and such other banks which face RBI restrictions as cooperative banks are the ones that serve the ordinary people.

• The state/central registrar officials, RBI officials and independent auditors are to be held accountable for dereliction of their duties/ connivance/ collusion.

• The central/state government should conduct independent probe, book the culprits who colluded with the borrowers in defrauding these banks and take punitive action.

• The wilful default is to be made a criminal offence and the assets of the wilful defaulters are to be confiscated and adjusted against their NPAs.

• Any co-operative bank should not be put under moratorium of RBI for more than three months altogether; a solution has to be found out within that time-frame.

• The depositors’ money should be fully protected irrespective of the insurance coverage under DICGC.