R Karumalaiyan

THE union ministry of labour and employment released draft rules for the Code on Social Security, 2020 on November 13 “for information of all persons likely to be affected thereby”, unscrupulously avoiding the route of tripartite consultation with the stakeholders, the trade unions in particular. The Modi government has been working overtime to roll out labour law codification at the earliest so as to show its hyper-loyalty to the corporates. The draft rules on social security code have, therefore, been designed and articulated in a manner so as to substantially reduce the obligations of the employers in the matter of social security to workers in the code itself and make that arrangement perpetual and continuous by way of empowering the government open-endedly to decide, devise and alter the social security schemes through executive order. That means whatever statutory rights on social security so long available to workers were there, they would lose their statutory teeth and their fate is made dependent on the pleasure of the government/executive.

The draft rules have reiterated that process and have gone further ahead to deliberately create hurdles for their enforcement, to the advantage of the employers. It does not provide any new social security benefits to the workers, nor does it expand coverage in the least through any substantive enforceable provision, rather making it unenforceable in every possible opportunity; workers will be subjected to immense sufferings. In other words, it has gone further to curtail the government-guaranteed social security so as to place the workers at the mercy of the market for every aspect of their life.

EMPLOYEES’ PROVIDENT FUND

Our apprehension has evidently been proved that the very first rule, immediately after the definition clause, that is Rule 3 starts lecturing only about opting out of EPF and ESI, instead of expanding coverage. It goes further to the extent of granting deemed permission for exiting by establishment out of EPF coverage if no decisions were taken by CPFC/DG, as the case may be, within sixty days of such applications for exit made by the employer in this regard.

Regarding the manner of administration of the funds vested with the Central Board of Trustees (CBT), the EPF Act u/s 5A (3) says that “the Central Board shall administer the Funds vested in it in such a manner as may be specified in the Scheme”. Now the authoritarian BJP government and its bureaucrats want to rule the roost. That is why they drafted the rules so: “The Central Board shall administer the Funds vested in it within the ambit of the guidelines issued by the Central Government”. Thus, it empowers the central government to interfere and even ignore the tripartite body CBT in the matter of administering the workers’ fund in EPF – that means the administration of about ten lakh crore rupees of workers’ hard-earned money!

It is pertinent to note that the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952, is, to quote from the preamble, “an Act to provide for the institution of provident funds, pension fund and deposit-linked insurance fund for employees in factories and other establishments”. So, the EPFO’s main functions were to administer the schemes such as Employees' Provident Funds Scheme, 1952, the Employees' Deposit Linked Insurance Scheme, 1976, the Employees' Pension Scheme, 1995. Even on those core functions of EPFO, neither the Code nor Draft Rules have mentioned anything at all except simply mentioning in a repealing and saving section 164(3) of the Code that all the said schemes shall remain in force for a period of one year. That means the fate and future of these schemes still hang in balance.

EMPLOYEES STATE INSURANCE

In fact, all along the central governments have gradually been reducing the ESI contribution since 90s after liberalisation from 7.25 per cent to 4 per cent of wages. Now they want to bring that ESI corpus down further by changing the definition of ‘wage’ on the plea of increasing the “take-home-salary” of the employees. It is nothing but an attempt to dismantle the workers’ self-funded health assurance scheme as it is basically against the doctrines of market economy – the corporate health insurance business. Hence, for the purpose of Rule 20 which is fixing the rate of contributions to ESI, the term “wage” has to be defined as it was done in the parent Act.

To camouflage the neoliberal offensive on State-funded social security, on September 23 when Rajya Sabha passed the three codes, labour minister Santosh Gangwar declared that ESI is going to be implemented in all 740 districts as the code has also promised for extension of ESI facilities to unorganised along with the gig and platform workers. But the draft rules of the same code remained absolutely silent about that obligation provided in the code.

The ESI Corporation is, in consultation and cooperation with the state governments, providing certain benefits as per the laid-down scheme to workers in case of sickness, maternity, and employment injuries. These medical expenses are being shared by the ESI and the state governments in such proportion as may be agreed between them. This is being done through concerned ESI directorates of the state governments functioning either under health or labour departments.

But draft rule 28, now, while defining the structure of such state level bodies constituted by the state governments for the purpose, stipulates creating societies registered under the state specific Society Registration Act/ Trust Act. It is the most dangerous proposal. Whatever may be the structure it should be created under the code and must be a statutory body functioning under the state governments. It is all the more important to remember that ESI is giving Rs 3,000 per insured persons (IPs), i.e., workers towards these medical expenses to the state governments that is running to thousands of crores. The draft rules practically propose to demolish all control and superintendence of ESI as well as the state governments altogether through this “society business”. We should not allow this to happen.

MATERNITY BENEFITS

The maternity benefits rules, especially the draft rule related to crèche, violates the Social Security Code, 2020 itself. Establishing crèches section 67(1) of the SS Code requires every establishment employing “fifty or such number of employees as may be prescribed” to establish crèches “within such distance as may be prescribed” either separately or along with common facilities. But draft Rule 39(1) has changed the eligibility condition from the wider term of “employees” (which include men, women and other employees) to fifty “women employees”, which violates the Code. It is simple logic that in most establishments, this condition in the rules will relieve many establishments employing women workers from the obligation to set up crèches.

Moreover, the guidelines for setting up and running crèche facility under Maternity Benefit Act 2017 that was issued by the ministry of women and child development also stands violated by the draft rules. As per those guidelines, the use of crèche facility should be extended to children of age group of six months to six years of all employees including temporary, daily wage, consultant and contractual personnel. Crèches should be located near/at the work place site or in the beneficiaries’ neighborhood, within 500 metres. The draft rules should have incorporated these provisions in concrete terms.

Similarly, the code as well as the draft rules on ‘nursing breaks’ smacks of capital’s barbarity in the sense that it does not recognise the child’s right to food, leave alone breast feeding and parenting obligation to attend the child needs. The code says; “every woman delivered of a child who returns to duty after such delivery shall, in addition to the interval for rest allowed to her, be allowed in the course of her daily work two breaks”. The rules have gone further in restrictively defining those two breaks as of 15 minutes’ duration only for nursing the child until the child attains the age of fifteen months”. It must be changed according to the international child care standard and our WCD ministry’s guidelines.

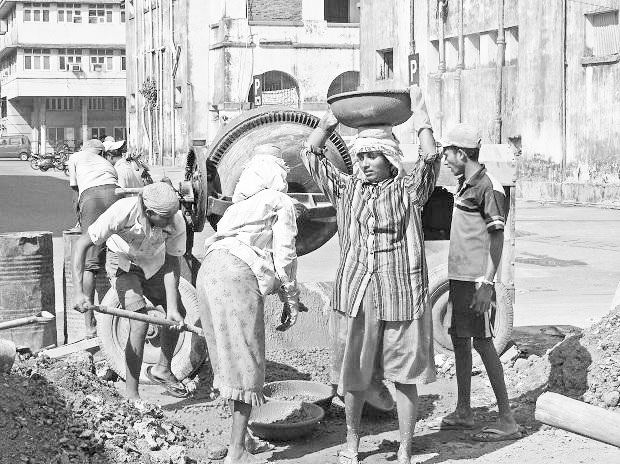

BUILDING AND CONSTRUCTION WORKERS

As per the Building and other Construction Workers Cess (BoCW) Act, all construction activities incurring cost of above Rs 10 lakh are bound to deposit cess at 1 per cent (in some states, 2 per cent) of the cost of construction to the state BoCW board. The cess so collected from the government/public and private sectors till March, 2020 is about Rs 52,000 crore. This is only corpus fund for 3.5 crore registered workers. The BoCW Cess Act was enacted to augment this resource. But the code, true to its original avatar, has already diluted the definition of “construction establishment” that are engaging building and construction workers. Now the draft rules have demolished the rest with a dubious intention of allowing the employer evading payment of due cess with impunity. Accordingly, the draft rules have diluted the provisions relating to the payment of cess and mooted a new procedure for ‘self-assessment’ in respect of building and other construction works. The thirty days’ time limit for payment of cess so levied has under the draft rules been further liberalized to sixty days.

The penal interest rate on delayed payment of cess is reduced from 2 per cent to 1 per cent every month. The present existing rules give power to the assessing officer for giving direction that no machinery or material can be removed or disturbed from the construction site till he/she finishes the enquiries/inspection. Now it is completely deleted from the rules. Further, under the draft rules, the assessing officer can visit construction sites only after obtaining the prior approval from the secretary of the building and other construction workers board contrary to the extant rules.

In totality, in the draft rules the violations and evasions in employers’ obligation have been rewarded with more concessions for more violations and evasions. In fine, the enforcement machinery to ensure payment of cess by the construction barons has been demolished through the draft rules in favour of the construction barons and the poor construction workers will be subjected to deprivation of their legitimate social security benefits that hitherto they enjoyed.

UNORGANISED SECTOR WORKERS

Indian economy is still continued to be dominated by the huge bourgeoning informal/unorganised sector. Hence, naturally, our workforce is characteriszed by the low income without any social security. The National Commission for Enterprises in Unorganised Sector (NCEUS) estimated that only 6 per cent such workers have received some sort of social security and the rest 94 per cent have been left without any such social protection. That was why then NCEUS, in fact, had recommended earmarking at least 3 per cent of GDP towards unorganised workers’ social security as this sector contributes around 63 per cent of GDP. The social security code as well as the draft rules has not addressed all those issues of these vast segments of our working populations.

Here, neither any institutional arrangements nor any state-funded schemes have been provided for in the draft rules. Rather the National Social Security Board (NSSB) for Unorganised Workers under the erstwhile Unorganised Workers Social Security Act has been restructured in the dubious direction of demolishing its tripartite character in a big way. Besides this, the draft rules remained absolutely silent about its terms of reference and system of functioning.

Section 6(2) (i) (ii) of the Code on Social Security, 2020 provides for the compulsory nomination of seven members of workers and employers of the unorganised sector to the National Social Security Board (NSSB). But Rule 9(1)(d) stipulation of “representatives” from workers’ associations of unorganised sector is dubious one to empower the government to select the workers’ representatives of their choice depriving the central trade unions from their rights to nominate their representatives in NSSB.

The social security code has mentioned that the schemes notified for the unorganised workers may be funded by the central government or/and the state governments either independently or jointly. Now the draft rule has neither notified any schemes nor worded anything on funding except a few words u/s 59: “Central Government shall identify the sources for initial funding/replenishing the Social Security Fund from time to time”. Without any concrete schemes and the corresponding funding arrangements the draft rules elaborate the procedures for managing the fund!

Though Indian Constitution and its Directive Policy contain all the ingredients on the obligations and responsibilities of the State towards the minimum realisation of some socio-economic rights, the present code and its draft rules have just moved and articulated in the opposite direction aimed at relieving the State further of most of its obligations so far as social security rights of mass or the working people in the unorganised sector in particular are concerned. And at the same time, whatever social security rights were earned by the organised working class through struggles have been severely tampered with, in order to pave the way for grossly diluting the statutorily enforceable rights of the workers in the days to come. The draft rules on social security code have articulated this misdeed from beginning to end. This is the real face of our prime minister’s vision of universal social security. The right to social security is an inalienable right of the workers who are the real creators of the wealth of nation. Thus, let us scale up the fight for universal social security, invariably linking the same with our ongoing fight for alternative policies.