C P Krishnan

THE information of write off of Rs 68,607 crores of Non-Performing Assets (NPAs) from 50 top wilful defaulters obtained from Reserve Bank of India (RBI) under Right to Information Act (RTI) by Saket Gokhale has been widely shared in the media throughout the country. This news has evoked many arguments, discussions and explanations in the social media. A section of the people argues that “it is only a technical write off; it does not mean that the borrowers would be allowed to go scot free. Still vigorous steps would be taken to recover the NPA”. They try to create an impression that most of the written-off amount would be recovered. Let us check the reality. First of all let us see what is write-off.

A NPA passes through various stages like sub-standard, doubtful and loss asset; then 100 per cent provision is made for that from the profit of the Bank; then it is written off by the Bankers after ascertaining that there is no scope for recovery. Only the Board of the Bank is empowered to write off large borrowings (five crore rupees and above).

Banks do take steps to recover the dues from the written-off accounts. But it does not yield much result. Let us see the table given below with regard to Public Sector Banks:

Year Loans written off (Rs. Crores) Written-off amount recovered (Rs.Crores)

2014-15 49,018 5,461

2015-16 57,585 8,096

2016-17 81,683 8,680

2017-18* 84,272 7,106

Total 2,72,558 29,343

*Upto December 2017

This information was obtained from the Rajya Sabha according to Vivek Kaul, a researcher of the NPAs of the Banks.

Thus out of the written off amount of Rs 2,72,558 crore only Rs 29,343 crore could be recovered. It works out to 10.8 per cent. It is seen from the practical experience that a huge portion of this recovered amount is only from the small borrowers. It is directly credited to the profit account as 100 per cent provision has already been made for the same out of the profit of the bank. It is clear from the above that 89.2 per cent of the written-off amount of Rs 2,43,215 could not be recovered. This amount is a total loss to the bank. The ruling party continue to assert that the whole written-off amount would be recovered. But reality is otherwise.

The next important aspect is that the list consists of 50 wilful defaulters. Who is a wilful defaulter? RBI’s circular defines a borrower as a wilful defaulter on four grounds — default even if there is capacity to repay, default even if there is capacity to repay but diverted the fund, default even if there is capacity to repay and siphoned off the money or default even if there is capacity to repay and disposed off movable and immovable assets given as securities without the knowledge of the bank. A three member team led by executive director will decide whether a borrower is a wilful defaulter based on the documents available. Sufficient opportunity will be given to the borrower to put forth his/her side of the arguments. Then a three member committee headed by managing director will review this and confirm. Then only the particular borrower will be declared as wilful defaulter. The loan of the wilful defaulter has to be recalled immediately. The willful defaulter should not be given any new loan or increase in the present limit by any bank or financial institution (RBI master circular on wilful defaulters dated July 1, 2015). According to Transunion CIBIL there are more than 11,000 willful defaulters as of December 2018 (Source: The Wire dated November 21, 2019).

Whenever attempts were made in the past 10 years to collect information about the written-off amount of the wilful defaulters, the RBI has been refusing to share the same on the ground that they have been holding the accounts in the fiduciary capacity and public sharing of such information will be against the interest of the country’s economy. Even for getting such information under RTI, one is forced to tap the doors of the supreme court. Only after stern warning of the Supreme Court of India in April 2019, the RBI was forced to disclose information about wilful defaulters in the public domain. The bank employees’ movement has been demanding of the government to declare wilful default as a criminal offence, take stern action against the wilful defaulters and recover their dues. Various agitation programmes including strikes were conducted pressing this demand. But the government at the centre has been totally indifferent to this demand and has been creating an illusion that a good portion of the written off amount would be recovered.

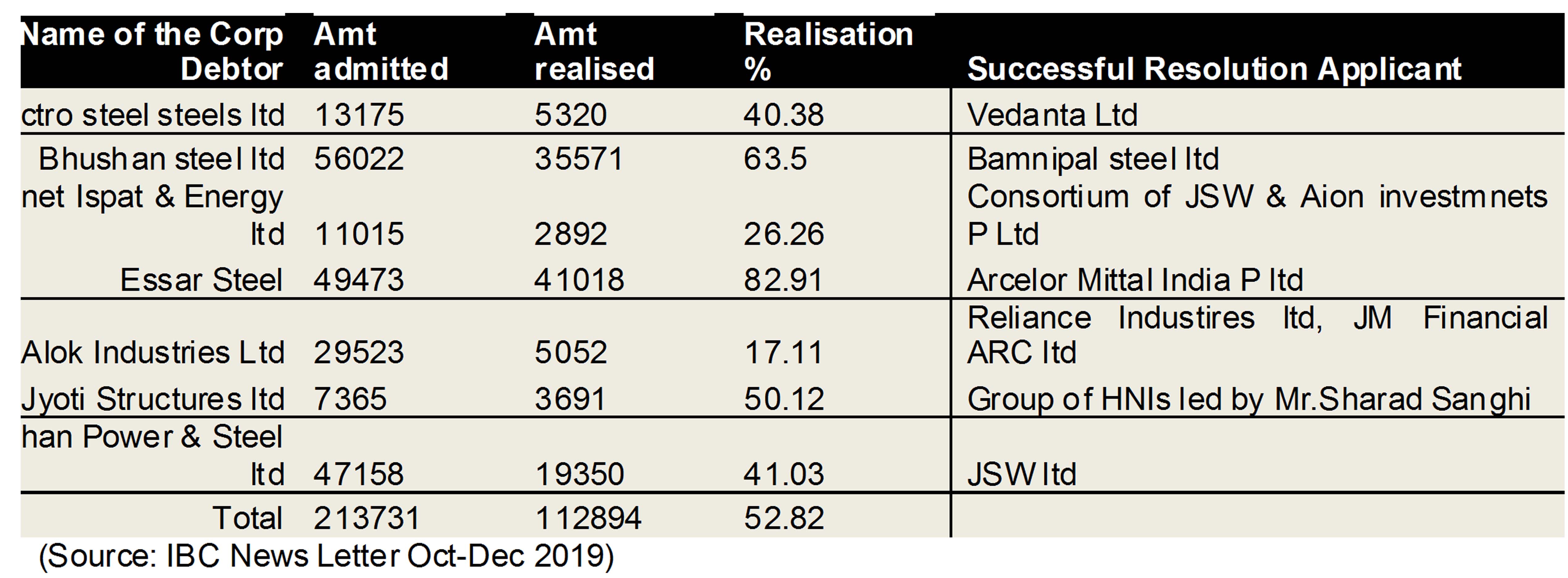

Another dimension of this issue also needs serious attention of the people. The BJP government at the centre brought an act called IBC (Insolvency and Bankruptcy Code) in May 2016. According to this Act, a board called Insolvency Bankruptcy Board would be created. The NPAs have to be taken up with this board, which in turn will refer the cases to NCLT (National Company Law Tribunal), which will resolve these NPAs either by selling the defaulting firms to others within 180/270 days or by liquidating them and selling the same in parts. Under the direction of RBI, in June 2017, banks have referred 12 largest NPA account holders amounting to Rs 3,45,000 crores constituting 25 per cent of the total NPAs of all the banks put together to the NCLT. Out of these 12 cases, 5 cases namely Amtek Auto Ltd., Era Infra Engineering Ltd., Jaypee Infratech Ltd., Lanco Infratech Ltd., ABG Shipyard Ltd., are pending resolution. The other seven cases have been resolved as detailed in the table.

The total amount NPAs of these seven accounts is Rs 2,13,731 crore out of which only Rs 1,12,894 crore could be recovered. This too would not come in single payment. It would be paid in installments in 4/5 years. The remaining amount of Rs 1,00,837 crores (which includes the written off amount of Rs 24,471 crore in the case of Alok Industries Ltd., taken over by Reliance Industries) is fully gone and will never come back. One private firm is purchased by another private firm. The loss has to be compensated to the bank by the borrower firm. But it does not happen. Only banks bear the brunt and they suffer huge loss wiping out their huge profit which puts them into great financial strain. The people’s money is thus looted and plundered. But the NPA borrower is not at all affected and escapes totally unhurt. Everything is done legally. Such is the ‘wonderful’ law called IBC enacted by this government. This is only a sample. Everyday tens of cases are ‘resolved’ by NCLT in this fashion.